capital gains tax increase news

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Romney says Trump was right to not cut capital gains taxes.

Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is.

. News Analysis and Opinion from POLITICO. Capital gains tax The Democrat-led state Legislature approved a 7 tax on capital gains over 250000 early in the year. Biden proposes nearly doubling the long-term capital gains tax rate for households with more than 1 million in income from its current 20 percent to 396 percent the same rate that they would pay under his plan on wages earned from working.

Capital Gains Tax Rate Update for 2021. While it technically takes effect at the start of. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

Major income tax changes in last 10 years and how they have impacted your investments. Capital gains tax rates on most assets held for a year or less correspond to. Capital Gains Tax Rate Set at 25 in House Democrats Plan Rate would rise from 20 under House panels proposal Biden had wanted to boost rate to 396 for highest earners.

According to a house ways and means committee staffer taxpayers who earn more than 400000 single 425000 head of household or 450000 married joint will be subject to the highest federal tax rate beginning in 2022. To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains. The underlying tax proposal is a hike in the capital gains tax from a top rate currently of 238 percent to 434 percent which is set to.

Capital gains tax The Democrat-led state Legislature approved a 7 tax on capital gains over 250000 early in the year. The underlying tax proposal is a hike in the capital gains tax from a top rate currently of 238 percent to 434 percent which is set to. Youll owe either 0 15 or 20.

By Ken Berry JD. Proposed capital gains tax. Capital gains tax would be increased to 288 percent.

The Biden administration recently released plans to increase the top capital gains tax rate for people earning over a million dollars a year to help pay for his American Families Plan. Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. Republicans waging war against President Bidens proposed tax increases are increasingly focusing their opposition on one floated change to capital gains.

Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. Long-Term Capital Gains Taxes. Bidens expected 6 trillion budget assumes that his proposed capital-gains tax rate increase took effect in late April meaning that it would already be too late for high-income investors to realize gains at the lower tax rates if Congress agrees according to two people familiar with the proposal.

By Naomi Jagoda - 072421 500 PM ET. One of the changes announced was in April 2018. Capital gains tax would be increased to 288 percent.

In the state of Washington the governor has proposed a capital gains tax that could raise almost 1 billion if passed. It was announced that long-term capital gains beyond Rs 1 lakh from stocks equity funds. Capital gains tax would be increased to 288 percent.

To provide the most recent info on capital gains taxes weve collected data. The rate could be as high as 396 matching the top ordinary income tax rate before the Tax Cuts and Jobs Act TCJA. The Biden administration has proposed an increase in the current favorable capital gain rates for people earning more than 1 million.

When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

Capital Gains Accounting And Finance Capital Gain Finance Investing

Australia Crypto Tax Guide 2022 Koinly

Taxes In Belgium A Complete Guide For Expats Expatica

Stock Market News Live Updates Stocks Trade Mostly Higher Shaking Off Capital Gains Tax Increase Concerns

Australia Crypto Tax Guide 2022 Koinly

Pin By Correctdesign On Menu Iphone App Samples Tax Table Capital Gains Tax Accounting

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Who Is Exempt From Paying Capital Gains Tax

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Selling Stock How Capital Gains Are Taxed The Motley Fool

Stock Market News Live Updates Stocks Trade Mostly Higher Shaking Off Capital Gains Tax Increase Concerns

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

Pin By Nawaponrath Asavathanachart On 1945 Capital Gains Tax Germany And Italy Capital Gain

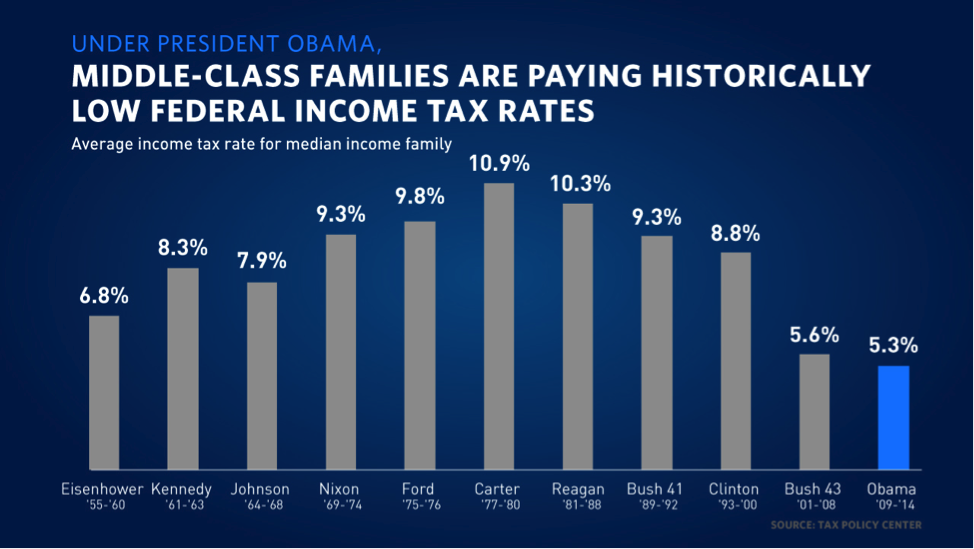

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)